Learn the latest trends business innovation with the Educational Programe

Learn the latest trends business innovation with the Educational Programe

Identify the range of macro-economic issues currently impacting on the economy of Papua New Guinea and link appropriate

macro-economic management strategies to those issues.

Inflation: the sustained increase in the general level of prices over a period (usually one year), measured by an increase in the consumer price index (CPI)

Inflation expectations: the opinion that households and firms have of the future rate of inflation

Inflation rate: the % change in prices over time, usually one year

1. Demand-Pull Inflation: inflation that results from excessive demand

2. Cost-Push Inflation: inflation that results from rising production costs

3. Imported Inflation: inflation that results from an increase in the price of imports

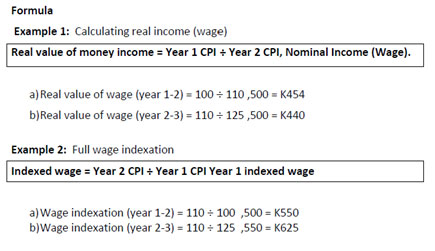

Inflation:reduces the purchasing power of money and reduces living standards. The value of money decreases as inflation rises.

Who suffers because of inflation?

Who gains because of inflation?

What are the other impacts of inflation

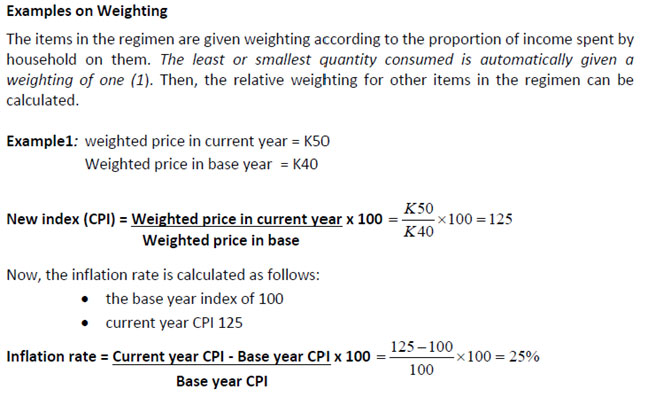

Inflation is measured by the Consumer Price Index (CPI) – a measure used to show changes in the average price of goods/services over time.

How is CPI calculated?

Price control: setting/fixing maximum prices or setting limits for price rises/control the increase in prices of goods/services

Wage control: minimise increase in minimum wage and does not allow excessive wage increases

Wage freeze: government placing a temporary ban on wage increases if the economy is experiencing high inflation

Fiscal policy: pass surplus budget to reduce government expenditure which reduces money supply and controls inflation

Tight/restrictive monetary policy: raising interest rates and decreasing lending, selling government securities on the open market operation, increase LGS ratio - all of which reduce money supply in the economy (contracting the economy) and controlling inflation

Inflation: long term general increase in the average price level of goods/services; it is measured using CPI (Consumer Price Index)

The three types of inflation are imported inflation, demand-pull inflation, and cost-push inflation