Learn the latest trends business innovation with the Educational Programe

Learn the latest trends business innovation with the Educational Programe

Identify the range of macro-economic issues currently impacting on the economy of Papua New Guinea and link appropriate macro-economic management strategies to those issues.

Macroeconomic policy conducted by a country’s reserve/central bank, to smooth out fluctuations in the economic cycle and counter their economic effects, with the goal of promoting the government’s economic objectives.

So, how do interest rates affect borrowing? Interest rates have an inverse relationship with lending (borrowing).

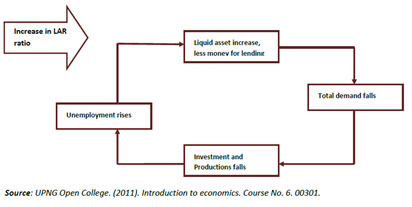

Liquid Asset Ratio (LAR): the proportion of total bank deposits (liabilities) put aside to meet customer demands for withdrawal.

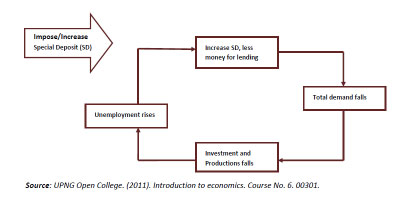

Commercial banks are required to hold a certain % of their deposits as “special deposits” with BPNG. This special deposit is not available for lending (required as a buffer).

Moral suasion: mutual co-operation between BPNG and commercial banks in implementing the monetary policies set by the central bank.

The effectiveness of monetary policy as an instrument of macroeconomic management is enhanced by the short inside time lags involved with its implementation, but significantly reduced by the long- and variable-time lag before policy changes are fully transmitted and change the level of economic activity.

Inside Lag: the time it takes to recognise that the state of the economy indicates the need to use counter-cyclical macroeconomic policy, decide on the appropriate policy response and implement it

Outside Lag: the time it takes for the policy measure to have its effect on the targeted economic variables and the level of economic activity

Lack of expertise

Lack of advanced technology and systems in place for quick, accurate data collection/analysis

Large existence of informal sector which contributes a large %/amount to overall GDP and is not (properly) accounted for

So, what are the types of monetary policy?

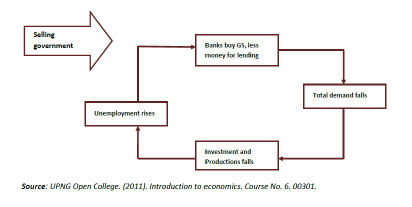

1. Restrictive/Tightening Monetary Policy: aims to restrict credit and limit the growth of money supply (Contract the Economy).

2. Expansionary/Stimulative Monetary Policy: aims to credit and increase the growth of money supply (Expand the Economy)